Investment Stewardship 2024 Annual Report

Investment Stewardship program

Vanguard’s Investment Stewardship program has a clear mandate to safeguard and promote long-term shareholder returns on behalf of the Vanguard-advised funds and their investors. We carry out this mandate by promoting corporate governance practices associated with long-term shareholder returns at the companies in which the funds invest, without directing the strategy and operations or influencing the control of those companies. When portfolio companies held by the funds generate shareholder returns over the long term, the funds generate positive returns for their investors.

The Vanguard-advised funds

Vanguard-advised funds are primarily index funds managed by Vanguard’s Equity Index Group. [1] Vanguard-advised equity index funds are designed to track specific benchmark indexes (constructed by independent, third-party index providers), follow tightly prescribed investment strategies, and adhere to well-articulated and publicly disclosed policies. The managers of Vanguard’s equity index funds do not make active decisions about where to allocate investors’ capital. In other words, instead of hand selecting the stocks in which an equity index fund invests, managers of these funds buy and hold all (or a representative sample) of the stocks in a fund’s benchmark index. [2]

An equity index fund will generally hold stock in a company for as long as that company is included in the fund’s benchmark index. As a result, Vanguard’s equity index funds are long-term investors in public companies around the world. A small portion of the funds are managed by Vanguard’s Quantitative Equity Group using proprietary quantitative models to select a broadly diversified portfolio of securities aligned with a fund’s investment objective. [3]

Our approach

All aspects of Vanguard’s Investment Stewardship program are focused on safeguarding and promoting long-term shareholder returns with the goal of giving investors in Vanguard-advised funds the best chance for investment success. The funds’ portfolio construction process is inherently passive—the equity index funds seek to track benchmarks determined by unaffiliated, third-party index providers. Our execution of proxy voting and engagement with portfolio companies operates in that context.

Accordingly, with respect to portfolio companies held by the funds, we do not seek to influence or dictate portfolio company strategy or operations, nor do we submit shareholder proposals or nominate board members. We believe that a well-composed board of directors that oversees a properly incentivized management team is best positioned to determine the strategies and tactics for maximizing long-term investment returns at an individual portfolio company. Similarly, Vanguard does not use investment stewardship activities to pursue public policy objectives. Setting public policy, including policy on environmental and social matters, is appropriately the responsibility of elected officials.

On behalf of the funds, Vanguard’s Investment Stewardship team seeks to understand how boards of directors ensure effective governance of the companies in which the funds invest. In keeping with the funds’ proxy voting policies, we examine how each board is composed to provide for the long-term success of their company, how it consults with management on strategy and oversees material risks, how it aligns executive financial incentives with shareholder returns, and how it safeguards the rights of shareholders. We do this by:

- Engaging with portfolio company directors and executives to learn about each company’s corporate governance practices and to share our perspectives on corporate governance practices to inform the funds’ votes associated with long-term shareholder returns

- Voting proxies at portfolio company shareholder meetings based on each fund’s proxy voting policies

- Promoting corporate governance practices associated with long-term shareholder returns through our published materials and participation in industry events

Our four pillars

Our analysis of companies’ corporate governance practices is centered on four pillars of good corporate governance. These four pillars guide our efforts when we engage, vote, and share our perspectives on corporate governance practices. These pillars are the foundation of the funds’ proxy voting policies, and each pillar links back to our focus on long-term shareholder returns.

Board composition and effectiveness

Good governance begins with a company’s board of directors. We seek to understand to what extent board members, who are elected to represent the interests of all shareholders, are suitably independent, capable, and experienced to carry out their duties. We also aim to understand how boards assess and enhance their own effectiveness over time.

Board oversight of strategy and risk

Boards should be meaningfully involved in the formation, evolution, and ongoing oversight of strategy. Similarly, boards should have ongoing oversight of material risks to their company and establish plans to mitigate those risks. We work to understand how boards of directors are involved in strategy formation and evolution, oversee company strategy, and identify, govern, and disclose material risks to shareholders’ long-term returns.

Executive pay

Sound pay policies and practices linked to long-term relative company performance can drive long-term shareholder returns. We look for companies to provide clear disclosure about their compensation policies and practices, the board’s oversight of these matters, and how the policies and practices are aligned with shareholders’ long-term returns.

Shareholder rights

Shareholders have fundamental rights as company owners. We believe that a well-functioning capital markets system requires that companies have in place governance practices and structures that enable shareholders to exercise those rights.

Investment Stewardship activity at a glance

In 2024, Investment Stewardship held nearly 2,000 engagements with or related to over 1,600 companies, representing 66% of the Vanguard-advised funds’ total assets under management (AUM). In addition, the funds voted on over 180,000 proposals at nearly 13,500 companies.

- 1,931 total engagements with or related to portfolio companies

- 1,603 companies engaged

- $4.5T AUM equity AUM engaged

- 182,241 proposals voted on

- 13,433 companies where a proposal was voted on

Regional roundup

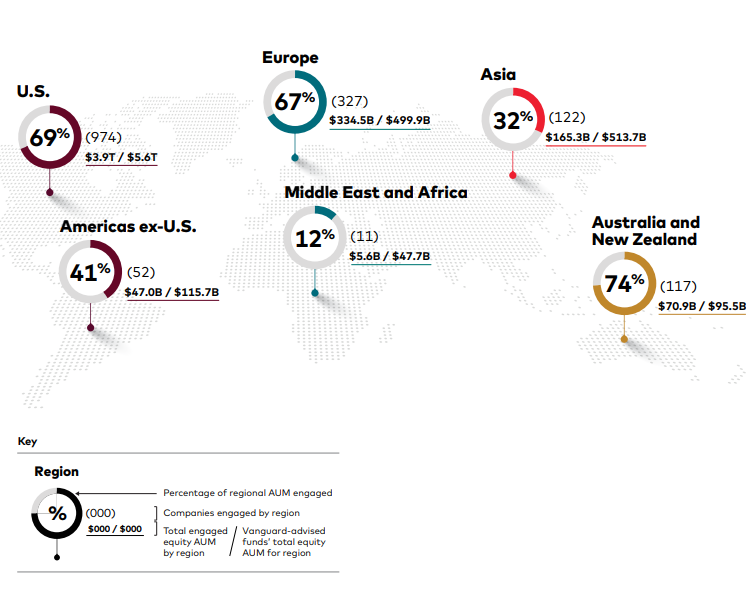

In this section, we highlight notable corporate governance topics and trends Vanguard’s Investment Stewardship team observed in various regions around the world in 2024.

We provide this report, as well as other publications, to give investors in Vanguard-advised funds and other interested parties an understanding of our engagements and proxy voting on behalf of Vanguard-advised funds.

Regional company engagement figures for 2024

The following figures represent the Vanguard Investment Stewardship team’s global engagement activities on behalf of the Vanguard-advised funds in 2024. [4]

U.S.

In the U.S., our investment stewardship activities continued to reflect the consistency of our approach—defined by the funds’ passive investment strategies and anchored by a focus on long-term shareholder returns—in the face of complex and dynamic market developments. We engaged with company leaders to understand their approach to board and committee composition; their oversight of company management, strategy, and material risks; and their executive compensation practices. Overall, we engaged with 974 companies across the U.S. on a range of governance and risk oversight topics, and the funds voted on over 36,500 proposals at more than 4,000 portfolio companies in the region.

Board composition and effectiveness

In our engagements with leaders of U.S. companies, we frequently discussed topics related to board composition and effectiveness, including director education, disclosure of director skill sets, and how boards oversee executive succession planning.

We observed that many issuers reported a focus on director education in areas such as AI and technology development broadly to ensure their directors are positioned to carry out their oversight duties. We noted that companies are taking different approaches to incorporating AI and evolving technology risk oversight into their governance and committee structure and responsibilities. Board member skill and experience, and how companies provide disclosure of the ways in which their boards’ collective skill sets link to their articulated business strategy, were frequently discussed. We used those discussions to understand how the skills and experiences in the boardroom and in their refreshment approach aligned with each company’s business and needs. We also discussed with several companies their boards’ approaches to navigating leadership transitions in light of market volatility.

We have observed a number of high-profile cases where companies have faced pressure for management changes from vocal, activist shareholders, and we have seen an increase in CEO resignations across S&P 500 issuers in recent years. Engagements on this topic reinforced the critical role boards play in ensuring long-term shareholder returns creation through intentional succession planning.

Board oversight of strategy and risk

In 2024, companies continued to focus on disclosure and discussions of board oversight of material risk areas. Companies touched on common risk areas such as cybersecurity, emerging technologies, and human capital, as well as more idiosyncratic risks specific to their industry or business strategy. Boards frequently noted the quickly evolving nature of these risks—and related business opportunities—in the context of board oversight and governance structures.

- 54% The percentage of shareholder proposals voted on at the top 200 largest U.S. companies.

- 3% The funds’ shareholder proposal support rate at the 200 largest U.S. companies.

- 13% The funds’ shareholder proposal support rate at the remaining U.S. portfolio companies.

Over the course of the year, the funds evaluated 401 shareholder proposals that requested actions from U.S. portfolio companies related to risk oversight practices that were focused, to one degree or another, on environmental or social matters. After our case-by-case application of the funds’ voting policies, the funds did not support any of these proposals. We assessed that many of these proposals sought overly prescriptive actions that were not aligned with the relevant company’s stated strategies or did not appear justified based on the financial materiality of the topic in question at the company. In other cases, we observed that proposals sought action on matters already addressed by the company.

Executive pay

The funds voted on over 5,000 executive pay-related proposals at U.S. portfolio companies during 2024. In evaluating these proposals, we remained focused on how a company’s executive pay program aligned pay outcomes with company (and shareholder) performance outcomes relative to a relevant set of industry peers. We looked to disclosures of the board’s oversight and explanation of the plan structure to provide context for how the board believed pay decisions and plan design would lead to alignment between executive rewards and shareholder return outcomes. In cases where pay plans focused more heavily on absolute metrics (that is, targets that are measured against future company performance), we looked for disclosure about the rigor of the target-setting process and demonstrated sensitivity of pay to performance outcomes. As in previous years, we continued to observe the use of one-time awards by certain U.S. companies as a part of their compensation program. Boards frequently cited retention and recruitment of top executive talent in a competitive market as the rationale for such awards.

Shareholder rights

In 2024, we analyzed various management proposals that included requests to amend companies’ governing documents to remove supermajority vote standards, adopt officer exculpation provisions through shareholder approval, and separate chair and CEO roles. We evaluated each proposal based on the specifics of the requested change, the company’s existing provisions or practices, and the impact these changes would have on shareholder rights. In many instances, we engaged with the companies in question to understand their rationales for putting forth the proposed changes.

We continue to believe in the importance of governance practices that safeguard shareholder rights, as we view such practices as being associated with long-term shareholder returns.

1For the 12 months ended December 31, 2024, equity index portfolios advised by Vanguard represented 99% of the Vanguard-advised equity funds’ total assets under management.(go back)

2Vanguard-advised equity index funds are constructed using either a full replication or sampling approach. Under a full replication approach, a fund buys and holds the securities in the fund’s benchmark index in proportion to each security’s weighting in the fund’s benchmark index. Under a sampling approach, a fund buys and holds a representative sample of securities in the index that approximates the full index in terms of key characteristics.(go back)

3Audit, Compensation and/or Nominating and Governance committees.(go back)

4In aggregate, as of December 31, 2024, the funds managed in whole or in part by Vanguard’s Quantitative Equity Group represented approximately 1% of the Vanguard-advised funds’ equity assets under management.(go back)

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release